LIC | Life Insurance Corporation of India

The Life Insurance Corporation of India (LIC) is a state-owned insurance and investment corporation. Established in 1956, LIC is the largest life insurance company in India, providing a wide range of insurance products and services, including life insurance policies, health insurance, investment plans, and pension schemes. LIC is known for its strong market presence, extensive customer base, and significant contributions to the Indian economy through investments in various sectors.

Policies

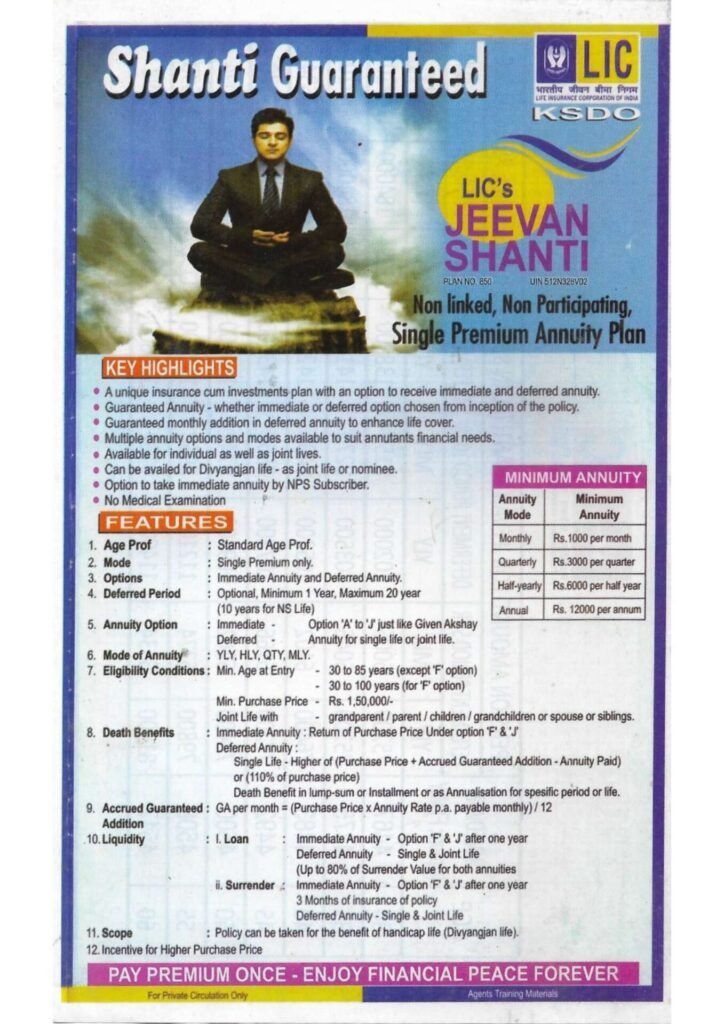

LIC Jeevan Shanti

LIC Jeevan Shanti is a single premium annuity plan offered by the Life Insurance Corporation of India (LIC). It provides a secure and reliable source of regular income, making it an attractive option for retirees or those seeking financial stability in their later years. The plan offers various annuity options, including immediate and deferred annuities, allowing policyholders to choose according to their financial needs and goals. Additionally, LIC Jeevan Shanti offers benefits such as guaranteed returns, flexible payment modes, and the option to include a joint life cover, ensuring long-term financial security for the policyholder and their family.

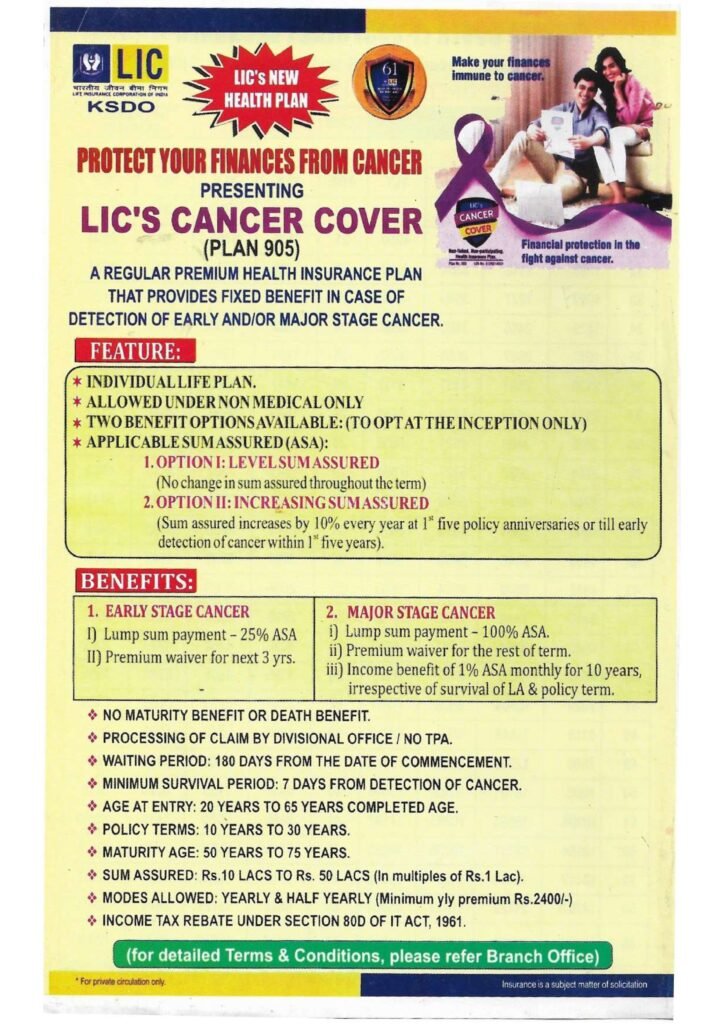

LIC Cancer Cover

LIC Cancer Cover is a specialized health insurance policy offered by the Life Insurance Corporation of India (LIC) that provides financial protection specifically against cancer. This plan covers both early and major stages of cancer, offering a lump sum benefit upon diagnosis. It helps policyholders manage the high costs associated with cancer treatment, including hospitalization, chemotherapy, radiation, and surgery. The policy features affordable premiums, no claim bonus, and a fixed premium for the entire policy term, ensuring that the insured can focus on recovery without worrying about financial strain. Additionally, the policy offers flexibility in choosing the sum assured and the policy term, catering to the diverse needs of policyholders.

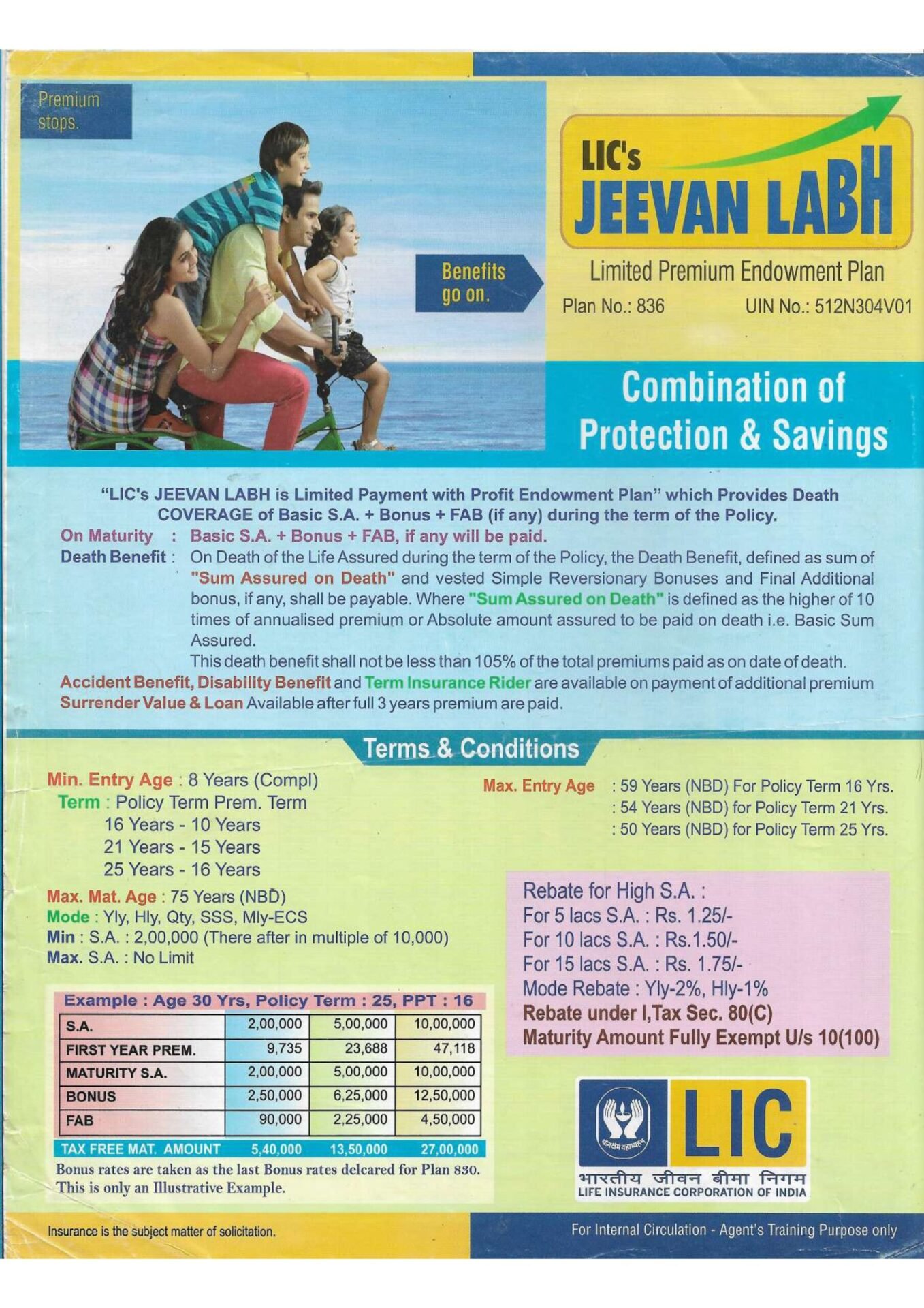

LIC Jeevan Labh

LIC Jeevan Labh is a limited premium, non-linked, with-profits endowment plan offered by the Life Insurance Corporation of India (LIC). It combines the benefits of insurance and savings, providing financial protection to the policyholder’s family in case of an unfortunate event and a lump sum amount at maturity. The plan offers flexibility in premium payment terms and policy terms, making it suitable for various financial goals, such as funding education, marriage, or buying property. Key features of LIC Jeevan Labh include death benefits, maturity benefits, and participation in the corporation’s profit through bonuses. It is an ideal plan for those seeking a blend of risk cover and long-term savings.

LIC Jeevan Lakshya

LIC Jeevan Lakshya is a traditional, non-linked, with-profits endowment plan offered by the Life Insurance Corporation of India (LIC). It is designed to provide financial security and support for the policyholder’s family in case of the policyholder’s untimely death, along with a lump sum payout at the end of the policy term. One of the distinctive features of this plan is its regular annual payouts, which can help in managing immediate financial needs. The plan also includes bonuses, enhancing the policy’s value over time. With flexible premium payment options and comprehensive coverage, LIC Jeevan Lakshya is well-suited for those looking to secure their family’s future while also saving for long-term goals.

LIC Jeevan Arogya

LIC Jeevan Arogya is a health insurance plan providing coverage for critical illnesses, hospitalization, and medical expenses. It offers a lump sum benefit upon diagnosis, flexible premiums, and family coverage options, ensuring comprehensive health security and financial protection against medical burdens.

- Critical illness coverage

- Hospitalization and medical expenses

- Lump sum benefit on diagnosis

- Flexible premiums

- Family coverage options

- Comprehensive health security